DEFTF Stock: Performance Analysis and Future Predictions

Investors are always on the lookout for promising stocks, and DEFTF stock is making waves in the financial world. With its intriguing potential and unique market position, it’s caught the attention of both seasoned investors and newcomers alike. But what exactly is driving this interest? In this engaging performance analysis, we’ll dive deep into the history of DEFTF, explore its current standing in the market, identify critical factors affecting its performance, and examine expert predictions for its future trajectory. Whether you’re considering an investment or just curious about emerging stocks, there’s plenty to uncover here. Let’s take a closer look at what makes DEFTF stock tick!

History and Background of the Company

DEFTF, also known as DeFi Technologies Inc., has carved a niche in the rapidly evolving world of decentralized finance. Founded in 2020, its mission is to bridge traditional finance with blockchain technology.

The company’s innovative approach centers around providing institutional-grade exposure to digital assets. This vision places DEFTF at the forefront of a financial revolution.

Starting with asset management solutions, DEFTF quickly expanded its offerings. The introduction of diversified investment products aimed at both retail and institutional clients marked significant growth milestones.

Over time, the company has attracted attention due to its strategic partnerships and collaborations within the crypto space. These alliances have bolstered its reputation as a trusted player in digital finance markets.

Current Performance of DEFTF Stock

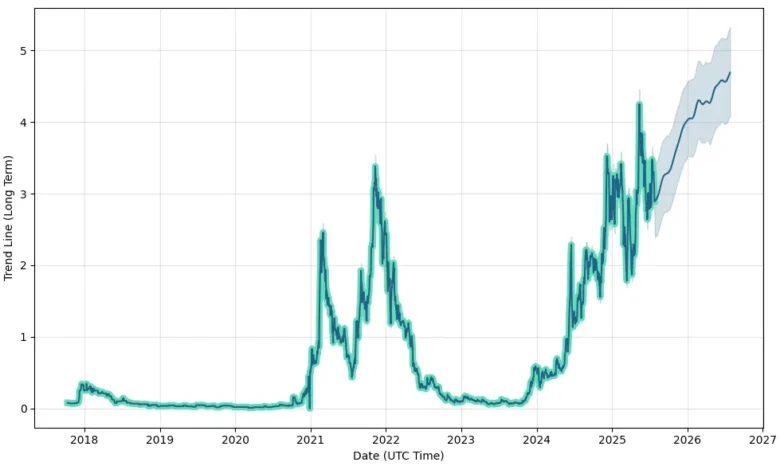

DEFTF stock has shown a mixed performance in recent months. After experiencing volatility, it has stabilized to some extent. Investors are keenly observing the trends as they unfold.

Recent trading data indicates fluctuations influenced by broader market conditions and sector-specific news. The stock’s price movement reflects investor sentiment and overall economic factors.

Volume levels have also been notable, with increased trading activity signaling heightened interest among retail and institutional investors alike. This could be indicative of future momentum or potential risks ahead.

Additionally, earnings reports have played a role in shaping perceptions around DEFTF stock. Analysts continue to dissect these results for insights into the company’s operational health.

As market dynamics shift, staying updated on DEFTF’s performance is crucial for anyone considering an investment decision in this space.

Factors Affecting the Stock’s Performance

Several factors influence DEFTF stock performance. Market sentiment plays a crucial role. Investor confidence can shift rapidly based on news or economic trends.

The company’s financial health is another important element. Earnings reports, revenue growth, and profit margins are closely monitored by investors. Strong fundamentals often lead to positive stock movements.

Industry dynamics also matter significantly. Changes within the sector may impact DEFTF’s competitive position. Regulatory changes or technological advancements might create new opportunities—or challenges.

Global events cannot be overlooked either. Geopolitical tensions or shifts in trade policies could affect market stability and investor behavior, ultimately influencing the stock price.

Macroeconomic indicators such as interest rates and inflation rates shape overall market conditions that can sway individual stocks like DEFTF dramatically. Understanding these interconnected factors is essential for anyone interested in this particular investment opportunity.

Analyst Predictions and Forecasts for DEFTF Stock

Analysts have varied opinions on DEFTF stock, reflecting differing views on the company’s potential. Some experts highlight strong fundamentals and growth prospects in emerging markets. They project a bullish trend, suggesting that strategic initiatives could drive significant revenue gains.

On the flip side, there are cautious voices who warn about market volatility and competition. These analysts believe external economic factors might pose challenges ahead for DEFTF stock.

Forecasts indicate a range of price targets, with optimistic projections reaching higher levels if the company meets its goals. Others suggest a more conservative approach due to uncertainties in global supply chains.

Sentiment leans toward optimism but remains tempered by caution. Investors should keep an eye on quarterly earnings reports as they will significantly impact future analyses and predictions for DEFTF stock.

Investment Opportunities for DEFTF Stock

DEFTF stock presents several enticing investment opportunities for savvy investors. The company has made significant strides in innovation, positioning itself as a leader in its sector.

Recent developments indicate that DEFTF is actively expanding its market presence. With new product launches and strategic partnerships on the horizon, there’s potential for substantial growth.

Investors should also consider the overall industry trends favoring companies like DEFTF. Rising demand and shifting consumer behaviors can drive future earnings.

Moreover, analysts highlight the stock’s historical resilience during market fluctuations. This track record may be appealing for those seeking stability amid volatility.

Engaging with DEFTF at this juncture could yield considerable rewards if you align your investment strategy with emerging trends and company milestones. Keeping an eye on quarterly performance reports will provide further insights into timing your entry into this promising opportunity.

Conclusion: Is DEFTF a Good Investment Choice?

As we evaluate DEFTF stock, a few key points emerge. The company’s history reveals growth and resilience in its sector. Recent performance indicates volatility but also potential for recovery and gains.

Many analysts see promise in DEFTF’s future, driven by industry trends and company strategies. Factors such as market conditions, competition, and economic shifts could influence the stock’s trajectory going forward.

For investors considering opportunities with DEFTF stock, it offers both risk and reward. It’s essential to weigh personal investment goals against market forecasts.

Whether DEFTF is a good investment choice hinges on individual circumstances and perspectives on the evolving landscape of the company and its industry.